Highlights of the result include:

- Total revenue up 3% to €92bn

- Underlying Earnings up 8% to €5.1bn

- Bottom line net income after tax up 12% to €5.0bn (slightly below market consensus)

- Free cash flow up 9% to €5.5bn

- Similar to insurers globally an increased dividend (up 17% on FY13) given high capital levels

- Debt gearing remained unchanged at a low 24%

- Solvency I ratio (a key measure of financial strength and capital levels) was up significantly from 221% at FY13 to 266% at FY14, driven by the impact of lower interest rates and strong contribution from underlying earnings

- Shareholder’s equity of €65.2bn at FY14 versus €52.9bn at FY13

- Total assets of €840.1bn at FY14 up from €755.4bn at FY13

Full details of the results are available on the AXA website  .

.

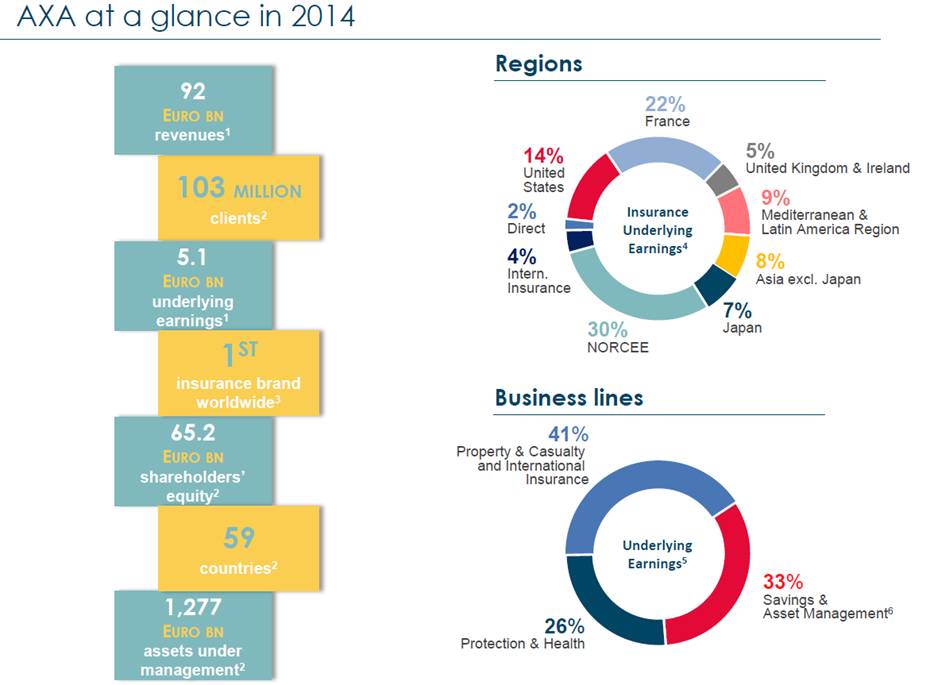

The first slide of the results presentation entitled, "AXA at a glance in 2014" (pictured below) is a good reminder of AXA’s size and stature in the global insurance market.

Relative value:

The results were broadly in-line with market expectations and we do not expect any material change in AXA’s credit spreads following the release. We remain comfortable with the AXA credit but highlight that AXA is one of the largest financial entities in Europe and as such will be impacted should there be a significant decline in the health European (and/or French) economy. On the positive side, it is a major beneficiary of the European Central Bank’s quantitative easing program, in part via its large holdings of government, financial and other highly rated bonds.

The AXA AUD Tier 1 securities are considered fair value, however are relatively short dated given our expectation of call in October 2016. Investors may consider taking profits on the AUD Tier 1 securities and extending maturities into other AUD bonds to improve returns. Those comfortable with non-AUD exposure may consider longer dated ‘old-style’ subordinated debt and Tier 1 securities that are offering attractive returns in the fours and five percent range depending on the currency, structure and first call date.

Source: AXA